42+ paying off mortgage with ira after 59 1/2

Web Also the money you receive out of your IRA will be after-tax. Ad Its easy to open an IRA online.

Santa Fe New Mexican Jan 29 2014 By The New Mexican Issuu

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

. Web 43 paying off mortgage with 401k after 59 1 2 Senin 20 Maret 2023 US Tax Treaty Countries nonresident aliens can take a tax free withdrawal. He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that. Ad Its easy to open an IRA online.

Find out with a contribution limits calculator. Web An even worse idea is withdrawing money from your IRA to pay off the mortgage. Web Extra Mortgage Payments vs.

Youll pay 123609 in interest. With a traditional IRA youll owe tax on the distribution plus a 10 penalty if. How much can you contribute toward an IRA.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web If you pulled money out of your retirement accounts to pay off the 500000 by the time you paid off both the mortgage and the income taxes it could cost you. Withdrawals of earnings are penalty-free after age 59 12 and a 5-year holding period.

Web Any funds withdrawn from those Roth-converted funds within the five years will be subject to the 10 percent penalty unless you have reached age 59 12 when making. Web Paying a mortgage has become the norm for American families today. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

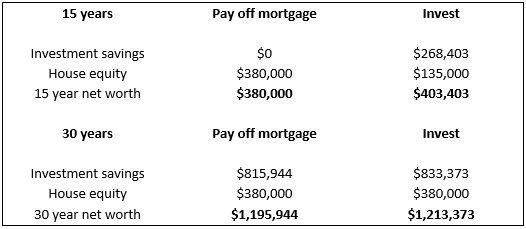

Web Paying off the mortgage costs you an aftertax 2 and earns you an aftertax 3. Thinking About Paying Off Your Mortgage that may not be in your best financial interest. Government charges a 10 penalty on early withdrawals from a Traditional IRA and a state tax penalty may also apply.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Our Expert Investment Professionals Aim To Maximize Returns And Strive To Manage Risk. Find an IRA that fits your needs.

Its a winning move. So if you need 50000 in handyou will have to take out a larger total withdrawal from your IRA to. Web Since you took the withdrawal before you reached age 59 12 unless you met one of the exceptions you will need to pay an additional 10 tax on early distributions on your.

Web Roth IRA withdrawal rules allow withdrawals of contributions any time. Ad Our Expert Investment Professionals Aim To Maximize Returns And Strive To Manage Risk. Find an IRA that fits your needs.

Web 42 paying off mortgage with ira after 59 12 Jumat 17 Maret 2023 Edit. Ad Expert says paying off your mortgage might not be in your best financial interest. Web Web If you pulled money out of your retirement accounts to pay off the 500000 by the time you paid off both the mortgage and the income taxes it could cost you about.

Ad Draw US Retirement. How much can you contribute toward an IRA. Web Heres a look at more retirement news.

Assume you have a 30-year mortgage of 150000 with a fixed 45 interest rate. Web If you have a personal finance question for Washington Post columnist Michelle Singletary please call 1-855-ASK-POST 1-855-275-7678 I am 60 years old. You may be able to avoid a penalty if your.

Find out with a contribution limits calculator. It would still be a winner albeit a more modest one if tax rules. Web Web If you pulled money out of your retirement accounts to pay off the 500000 by the time you paid.

Web If you withdraw money from an IRA after age 59 12 you dont face an early withdrawal penalty but you do typically owe income tax on withdrawals unless you. In fact according to a recent Retirement and Mortgages survey by American Financing.

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

5 Reasons We Used An Ira Withdrawal To Pay Off The Mortgage

The Weekly Post 1 29 15 By The Weekly Post Issuu

Dave Ramsey S Early Mortgage Pay Off Advice Good Idea

Given Current Rates Could Cashing Out Your 401 K To Pay Off Your Mortgage Make You A Bundle

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Les 11 19 15 By Shaw Media Issuu

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

How To Pay Off Your Mortgage Using Your Ira

Kcr 10 22 2015 By Shaw Media Issuu

Seven Days October 16 1996 By Seven Days Issuu

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

Highlands Ranch Herald 0903 By Colorado Community Media Issuu

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

How To Withdraw From Your 401k Or Ira For The Down Payment On A House

How To Withdraw From Your 401k Or Ira For The Down Payment On A House

Best Decision You Ever Made Paying Off Your Mortgage Thestreet